Do You Have a Plan for the Next Market Crash?

Our Invest and Protect Strategy is designed for unlimited upside with a tolerable downside. We are not here to make you rich quick; we are here to help you not become poor!

Too many people learned the importance of investment protection during the Great Recession of 2008. People near retirement were especially hard hit. We believe the five years before you retire and the five years after you retire make up the single most important decade of your financial life. Conventional wisdom may say that the market always bounces back. While that historically has been true, it often takes years. The market didn’t break even after 2008 until 2013! If you’re close to retirement, would you want to delay your retirement to regain that loss? And if you are retired, do you want to keep taking withdrawals as your nest egg plummets?

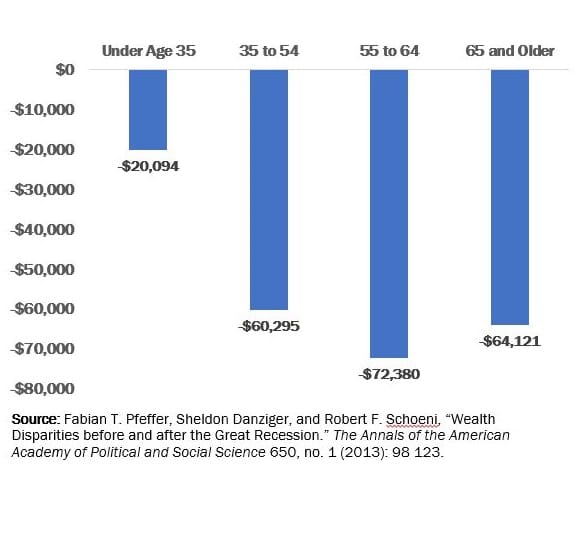

Change in Median Net Worth from 2007 and 2011, by Age of Household Head.

U.S. Adults Nearing Retirement (Ages 55 to 64) Saw the Largest Decline in the Dollar Value of Their Wealth Between 2007 and 2011.

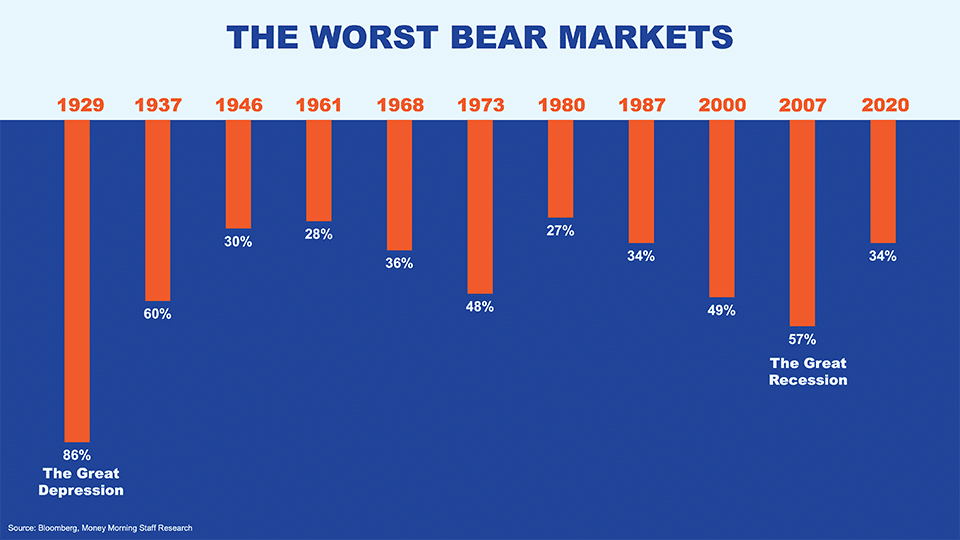

If you’re retired and living off your investments, what would happen if they dropped 57% like the S&P 500 Index did in 2008? Could you cut your cost of living in half while you waited for the market to come back?

Bear markets and downward spirals can be huge risks to your financial security – and could even lead to you running out of money in retirement.

We Can Help You Plan for Bear Markets

We believe growth is important, but protection of principal is more important. We want your money to last as long as you do. We believe protecting your retirement savings from market volatility is one of the best ways to do that. Are you ready to meet with a Retirement Planner to talk about how to plan for the next market crash?