Why Choose Us As Your Retirement Planner?

Our Invest and Protect Strategy is designed for unlimited upside with a tolerable downside.

We Specialize in Retirement

Our goals are for your money to last as long as you do and for you to have financial peace of mind. If you

are 50 or over, you’ve probably been saving for retirement for decades and have worked hard to get

here. That’s why we believe growth is important, but protection of principal is more important.

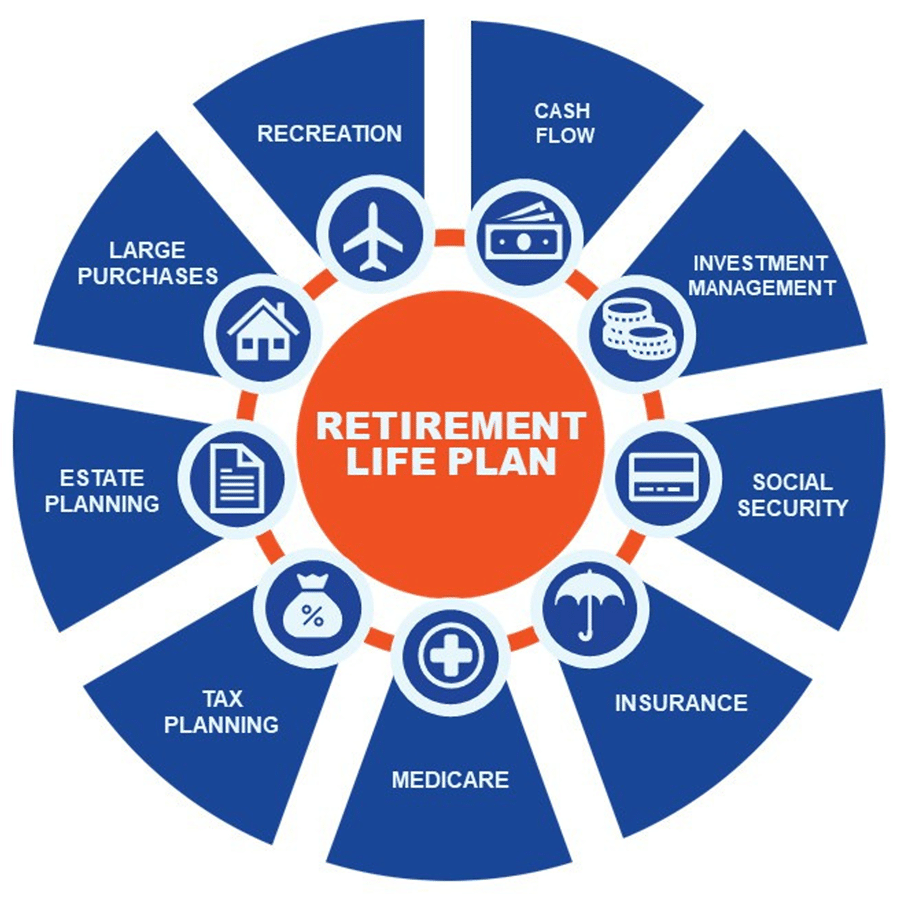

We believe retirement planning should go far beyond investment management. As a client of Retirement Planners of America, your multi-faceted retirement plan will address your unique needs for:

About Retirement Planners of America

Retirement Planners of America (RPOA) is a Dallas-based wealth management and investment firm with over $3.58 billion in assets under management and serving over 6,600 households in 48 states (as of 12/31/23). RPOA has 14 offices in Texas, Arizona, California, and Oklahoma. The firm's financial advisors work with pre-retirees and retirees, offering financial planning, investment management, Social Security planning, and income tax planning services. As a fiduciary-bound firm, we make decisions based on our core values, prioritizing our clients' retirement security.

Ready to work with a team that specializes in retirement planning?

Watch a short on-demand webinar.